More than half of Americans say they would need at least $100,000 a year to be financially comfortable. The benchmark of a six-figure salary used to be the gold standard income. It represented the tipping point of finally earning a disposable income and building a savings spending based on your wants, not just your needs. The American Dream is what makes a middle class lifestyle. You’re able to pay your bills.

You’re able to put food on the table, put a roof over your family’s head, and you have some additional savings. Now, people making well over six figures are still living paycheck to paycheck. What used to symbolize financial freedom is now keeping people stressed about making ends meet. 26% say they would need more a salary in the range of $100,000 to $149,000 per year would make them feel financially comfortable. I think, unfortunately, what has happened is that wages haven’t kept up with the cost of living, by and large, for the last 50 years or so, and so it becomes increasingly hard for many families to be able to attain that sort of middle class lifestyle, that American dream.

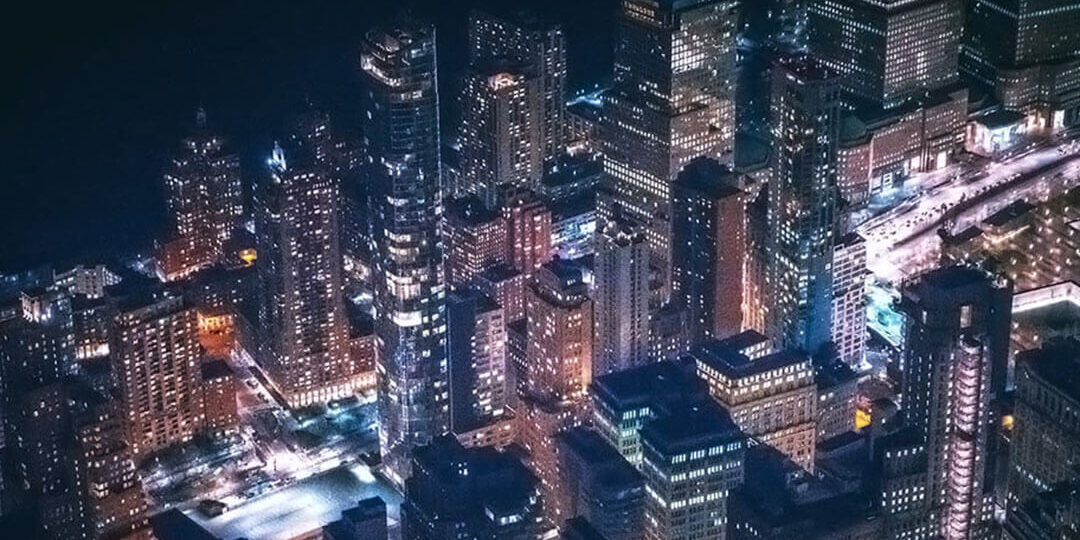

How much you need to feel financially secure varies so much depending on not only your geographical location, but of course, your lifestyle. It used to be that a six-figure salary was like the gold standard, but nowadays that may not be enough to make ends meet in certain parts of the country, especially like New York or San Francisco, where it costs so much more just to cover your daily expenses.

Here’s why a $100,000 household income no longer buys the American Dream. GoBankingRates analyzed how much a family of two adults and two children would need in each state to own a home, a car and a pet, as well as have an additional 20% of their income for savings and 30% for discretionary spending. The core of what the American Dream means is some amount of economic security that you feel like you can get by and do a bit better, maybe do better than your parents, maybe be able to afford a house.

Certainly be able to save for your children’s future. All 50 states require more than a $100,000 annual income, with 38 states needing more than $140,000. The most affordable states — Mississippi, Arkansas and Kentucky — need between $109,000 and $117,000. The median income for a household of four people in each of those states in 2022 was between $71,000 and $87,000. Hawaii, California and Massachusetts are the most expensive.

Each requires an annual income of more than $240,000. The median income for a family of four in those three states in 2022 fell at least $94,000 short of what’s required for the American dream.

A different analysis from AP found that in about 80% of the country, a family of four can afford their basic needs on less than $100,000 per year. Those include things such as housing, food, transportation, health care, child care, taxes and a few other basic necessities. It doesn’t take into account anything extra.

It’s really just putting food on the table, putting a roof over your head, getting health care for your family and so you’re not saving for a rainy day if something happens to somebody or if they lose their job. So there’s no extra in there for retirement, for kids college. Those are the kinds of things that many people want to save for. Those are the many things that people consider a part of the American dream. Only about 3% of those counties have a median income higher than the basic cost of living.

The idea behind the American Dream hasn’t really changed, even though lifestyles have. It used to be that you could get out of school, get a job, buy a home, and start a family. And now those milestones are harder to achieve. It used to be that a high school degree, you’re good to go. You could get a great job building cars or something and be right in the middle class off of a high school degree.

But now, in order to get into the middle class, a high school degree is clearly not enough. Right now, you got to pay for college. People are graduating with much larger student loan balances, and then it’s harder to be on that same sort of career trajectory that would provide the stability that you maybe would have had a generation ago to save up for the down payment on a home. Student loan debt reached an all time high of $1.77 trillion in the first quarter of 2023.

This can have a ripple effect, especially when entire generations are starting their adulthoods with thousands of dollars in debt. So when we think about the kinds of investments you want to make for your children, the cost of college has gone up a lot faster than overall inflation. So, trying to make those investments on a smaller and smaller paycheck compared to the cost of living can be very difficult and almost impossible. And so, the kinds of debt that young people can rack up going to college gets larger and larger, and your ability to then make ends meet yourself, be able to buy a car, be able to move out of your parents’ house.

Those things become much more difficult over time.

The American Dream typically is people owning property and having children, but that’s becoming largely inaccessible for many people, and even those who have attained these things are finding themselves managing every dollar coming in and out just to stay afloat. So that trade-off is underlying the new cost of the American dream. Millennials and Gen Zer’s still want to buy homes despite feeling like they can’t afford it. 62% of younger millennials and 63% of Gen Zer’s still say owning a home is part of the American dream. 66% of U.S. Renters surveyed say rising prices leave them feeling hopeless about ever owning a home. 72% of respondents say they can’t afford the down payment.

17% of all home buyers said that saving for the down payment was the most difficult task in the buying process, and 52% said student loan debt delayed their ability to save. The typical first time homebuyer in 2022 had a household income of $95,900.

Nationally, a prospective home buyer would need a nearly $110,000 salary to afford the principal interest, taxes and insurance payments on a median price home. But the median household income in the United States in 2022 was a little under $75,000. If you’re born into a nice neighborhood, which your parents have lots of wealth and lots of income, your chances of doing well are vastly improved. The part that’s home ownership. Collectively, Americans owe $1.

13 trillion on their credit cards. Inflation — it’s eroding people’s purchasing power.

It’s reducing their ability to save for their future or invest in these Longterm goals. So that loss of financial stability can create a sense of powerlessness and insecurity and contribute to feelings of uncertainty and vulnerability. It can really impact people’s self-esteem, their resilience, their overall psychological health.

Economists have suggested that debt growth became a substitution for income growth. More than a quarter of Americans said that they are doom spending or spending money despite economic concerns. There’s also this idea that young adults are feeling more discouraged in their own financial standing. So, in that way, they’re less inclined to even save for long time goals and more likely to just live in the moment.

It’s just sort of that mentality, like you only live once.

I may not buy a home anyway, so let’s take that trip or let’s go to that event, whether it’s a Taylor Swift concert or other, you know, big ticket item. 73% of Gen Zer’s say the current economy makes it difficult to set up long time goals. And it’s not just about revenge spending, it’s just about wanting to enjoy life and make the most of what you have, even if you can’t necessarily buy that home or you know you’re not starting a family just yet and you really want to, you know, feel good about yourself in the moment. People are indulging to the extreme, and I think we often buy because we think that it’s going to change our life or it’s going to give us this emotion that we feel like we’re missing.

And it’s like an endless trail of spending and constantly going to make us feel empty because we’re externalizing something that we need to give to ourselves.

I think that’s a big issue with consumerism, and it’s running rampant. Social media has changed the conversation so much, because there’s just been this abundance of the ability to see these glamorous, glorified lifestyles. It’s not only celebrities that are presenting themselves this way, but even your own peers, which makes a lot of people feel like they’re just not measuring up.

They can’t financially compete with what they’re seeing online. It has left a lot of people, especially young adults, feeling very discouraged in their own financial standing.

Even if they’re doing okay, they just may not feel that way when they compare themselves to what they’re seeing on social media. The question is, are you able, given kind of the luck of the birth lottery, are you able to have opportunities that are the same as those of people who may have been born into families that are in better circumstances than your own? The American dream is all about it shouldn’t matter. The birth lottery shouldn’t matter, right? So it’s deeply relative.

https://clickbankprofit.biz/access/268.htm

Discover more from Making Money Is Easy

Subscribe to get the latest posts sent to your email.

![[Explore 20241104] Colors of autumn [Explore 20241104] Colors of autumn](https://i0.wp.com/live.staticflickr.com/65535/54116799494_01eed0bc05_m.jpg?w=640&ssl=1)